Contact us: digitalwages@ilo.org

Building better financial futures for small enterprise workers in Central Java through financial education

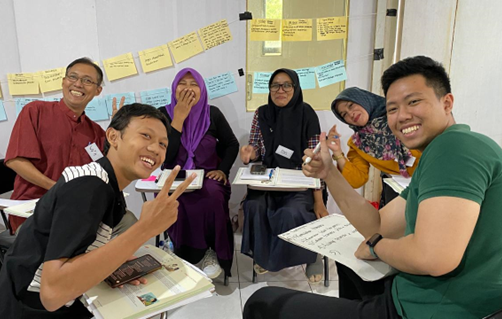

From August 5th to 8th, 2024, the ILO Global Centre on Digital Wages for Decent Work conducted a Financial Education training for 25 small business owners and workers in Central Java. The initiative also involved the participation of the Regional Government Cooperatives and MSME Office in Central Java Province.

The training aimed to empower business owners and workers in small enterprises with essential knowledge and practical tools to manage their income effectively, build financial assets, and reduce financial stress. By enhancing financial wellbeing, the program seeks to support healthier, more resilient lives, which can also contribute to improved performance in the workplace.

Better financial control for workers

The financial education training is part of the ILO Global Centre on Digital Wages for Decent Work’s efforts to support enterprises and workers in transitioning from cash to digital wage payments. Participants included workers and business owners from small enterprises previously involved in capacity-building and coaching activities focused on responsible wage digitization.

These activities provided small enterprises with tools to assist business owners and managers in transitioning to digital wages. One key resource was a roadmap outlining the main steps and needed for a responsible transition. The roadmap emphasizes the importance of engaging workers and offering continuous support, such as promoting financial literacy, with special attention to the most vulnerable groups.

Financial literacy is critical for workers in small businesses, who often have mid- to low-income levels and face less stable working conditions. It empowers them to make informed financial decisions that positively affect their personal and family finances. Equipping workers with the right knowledge helps them fully benefit from digital payments and other financial services while effectively managing risks and navigating consumer protection issues.

“I would prefer to receive my salary through bank transfer. Financial education training makes me more aware of the important of savings for the future.”

– Nikmah, Female, 19 years old, small business worker

The participatory training methodology encouraged participants to share their experiences and lessons learned on managing personal and family finances. By the end of the sessions, participants agreed on the importance of reliable sources of information, improved understanding of financial services, and responsible financial management. For many workers, this was their first exposure to financial education, and the training significantly enriched their understanding, offering insights into navigating personal and family financial matters.

“As a young adult who has just started earning my own income, financial education is an extremely important foundation. Because of this training, I am aware of the advantages and disadvantages of various existing financial products.”

– Mochammad Javier, Male,19 years old, small business worker

The role of business owners

Around 30% of participants in the Financial Education training were small business owners. These business owners are often seen as trusted figures among workers and frequently address financial management issues raised by them. Business owners’ participation in the Financial Education training aimed to enhance their capacity on the topic so they could disseminate knowledge among workers and provide tailored financial advice when appropriate.

Ms. Yuta Endang Pujiastuti, the owner of a small food processing enterprise, participated in the Financial Education training alongside her staff. Ms. Yuta’s business employs 10 workers and uses a mix of bank transfers and cash for wage payments. During the training session, she shared her experience and emphasized that financial health is crucial not only for the workers but also for her business. She believes it can positively impact workplace performance and reduce turnover. Ms. Yuta welcomed the Financial Education training provided by the ILO as a valuable tool for helping employers address these issues by building workers’ financial literacy.

Financial education for improved access to workers’ rights

The Financial Education training in Semarang piloted an adapted module of the ILO Financial Education Programme designed for workers in small enterprises. In addition to the usual topics covered by the Programme, this module includes elements related to wage payments, such as understanding employment contracts and payslips. One of its objectives is to enhance financial wellbeing by helping workers gain better control over their wages.

Most of the small enterprises that participated in the training operate in the informal sector and do not provide employment contracts or payslips. As emphasized in the training module, employment contracts clarify details such as employment duration, termination procedures, salary amounts, and wage payment processes, thereby offering workers a sense of job security and stability. Payslips provide workers with a clear and transparent record of their earnings, including gross pay, deductions, and net pay. This transparency helps workers plan and mitigate future risks, enabling them to manage their finances more effectively.

The Financial Education training raised awareness among both business owners and workers about the importance of employment contracts and payslips, encouraging them to consider implementing such practices. It underscores the need for greater support for business and employment formalization among Indonesian small enterprises and suggests that wage digitization activities could facilitate discussions on this topic, serving as a first step. The ILO Global Centre on Digital Wages for Decent Work, together with all stakeholders, is committed to supporting the transition to responsible digital wage payments while also promoting respect for workers’ rights.