Contact us: digitalwages@ilo.org

ILO promotes responsible digital wage payments in Indonesia

The ILO, in collaboration with its constituents and the University of Indonesia, held an online event to present the assessment on digital wages for decent work in Indonesia with over 120 participants. The assessment is part of the effort to accelerate the transition to responsible digital wage payments, particularly for small and medium-sized enterprises (SMEs).

In Indonesia, the access to and use of digital payments, including digital wage payments, tend to be unevenly distributed. Indonesian small and medium-sized enterprises (SMEs), which represent the vast majority of enterprises and employees in the country, have been slower in embarking on the wage digitization journey.

Despite rapid advances in the digitization of payments, the majority of women and men workers in Indonesia receive their wages in cash. Responding to this situation, the ILO’s Global Centre on Digital Wages for Decent Work and the ILO Country Office for Indonesia and Timor-Leste recently launched a Rapid Assessment on Digital Wages for Decent Work in Indonesia. Conducted by the Institute for Economic and Social Research – Faculty of Economics and Business, University of Indonesia (LPEM FEB UI), the assessment addresses the prospects for responsible digital wage payments in the country, particularly for SMEs in the garment and retail trade sectors. It provides insights on the opportunities and the challenges for the transition to digital wage payments in a responsible manner that benefits workers, enterprises, the government, and the ecosystem.

“This study contributes to concrete actions that bring efficiency gains for employers and financial inclusion and empowerment for workers, particularly the most vulnerable, including women,” said Teguh Dartanto, Head of Poverty and Social Protection, LPEM FEB UI.

“This is urgent, important, and inevitable with the fourth industrial revolution.”

– Anwar Sanusi, Secretary General of the Ministry of Manpower

Covering 20 key informants, 21 small enterprises in the retail and garment sector and 110 women and men workers, the assessment found that despite the recognition of the benefits of digital wage payments, there are still challenges hindering the transition, which vary across stakeholders.

The assessment revealed that digital wage payments become more prevalent as the size of the enterprise grows. Smaller enterprises willing to digitize wage payments may meet resistance from their workers. Workers’ preference for cash wages reflects workers’ need to use cash for their daily transactions, the high costs of using (digital) financial services, concerns about the reliability and trustworthiness of the services, and workers’ limited capacity to use them. Nevertheless, most interviewed workers also mentioned that they would feel satisfied with digital wage payments that address their concerns.

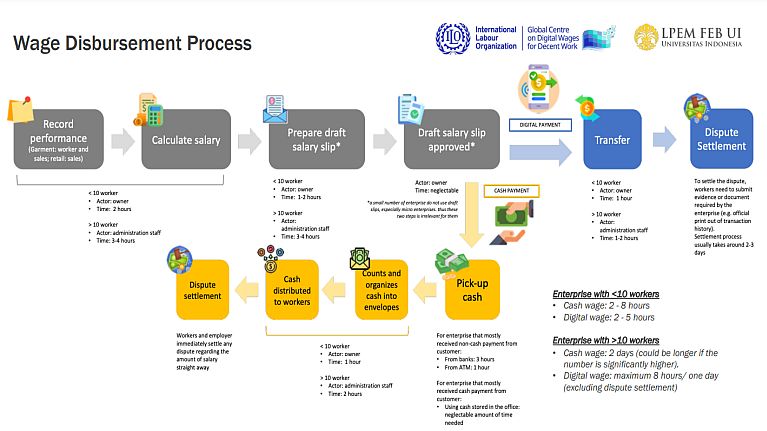

The assessment also exhibited the efficiency of digital wage payments. It showed that for an enterprise with more than 10 workers, it only takes a maximum of one day to disburse wages digitally, compared with two days for cash wages.

The assessment includes short, medium and long-term recommendations. In the short-term, for example, it recommends promoting existing digital financial inclusion initiatives to boost awareness and adoption by both workers and small enterprises. Meanwhile, the medium- and long-term recommendations highlighted the need for policy development to enable SMEs to grow and formalize, regular social dialogue on responsible digital wage payments, improvement in financial and digital literacy, as well as a more inclusive and secure digital finance ecosystem.

“The assessment is the first research exploring the prospects for responsible digital wage payments in Indonesia. Its findings and policy recommendations have implications on other policy areas such as the transition from the informal to the formal economy,” concluded Jahen F. Rezki, Head of the Macroeconomics and Political Economy Research Group (LPEM-FEB UI) and lead researcher for the rapid assessment.

“We also need to strengthen financial education and consumer protection. I greatly appreciate the assessment, which will inform the development and uptake of digital financial services.”

– Onny Widjanarko, Executive Director of DKI Jakarta Province Bank Indonesia Representative Office

Key financial and labour actors in Indonesia provided their reflections on the findings and recommendations. Anwar Sanusi, Secretary General of the Ministry of Manpower, welcomed the initiative and emphasized the need for greater financial infrastructure readiness to support the transition from cash to digital wage payments, particularly in rural areas. “This is urgent, important, and inevitable with the fourth industrial revolution. At the Ministry of Manpower, we see this as a transformation we really need to adopt,” he added.

Similarly, Onny Widjanarko, Executive Director of DKI Jakarta Province Bank Indonesia Representative Office, emphasized the urgency of infrastructure equity within the country, particularly for undeveloped regions, alongside addressing ecosystem, institutional, regulatory financial access issues. “We also need to strengthen financial education and consumer protection. I greatly appreciate the assessment, which will inform the development and uptake of digital financial services,” Onny Widjanarko said.

Both representatives of workers and employers—Elly Silaban, President of the Confederation of All Indonesian Trade Union (KSBSI) expressed support for the initiative, and highlighted the need for measures to support workers, particularly those in the informal economy. Aloysius Budi Santoso, Deputy Chair for Employment of the Indonesian Employers’ Association (Apindo) expressed appreciation for the study. He underscored the importance of financial inclusion and education for SMEs and their workers, to support the digital wage payment transition and the transition from the informal to the formal economy.

Isvary Sivalingam, South-East Asia lead of the UN-based Better Than Cash Alliance, presented the UN Principles on Responsible Digital Payments . She highlighted the principles on fair treatment of users, fund protection and accessibility, client data safeguards, transparency, and prioritization of women.

The ILO Country Office for Indonesia and Timor-Leste and the ILO’s Global Centre on Digital Wages for Decent Work will continue the dialogue with national stakeholders to operationalize the recommendations and accelerate transition to responsible digital wage payments in Indonesia.

The live streaming of the launch and discussion can be viewed on ILO TV Indonesia. The presentation of the findings can be found here.