Contact us: digitalwages@ilo.org

Peru’s micro and small enterprises strengthen their capacities to move towards digital wage payments | Las micro y pequeñas empresas del Perú fortalecen sus capacidades para avanzar hacia el pago de salarios digitales

Lea el artículo en español aquí.

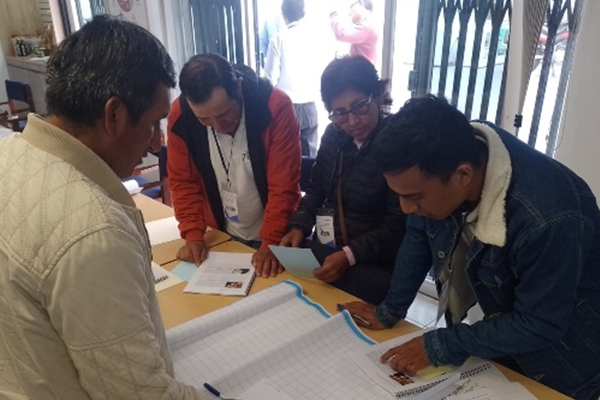

The Chambers of Commerce of Cusco and La Libertad, the Centro Ecuménico de Promoción y Acción Social (CEDEPAS) Norte, the Centro de Integrado Formaliza Perú of La Libertad region, the national programme Tu Empresa of La Libertad and Cusco and the Municipality of Wanchaq of Cusco, in collaboration with the ILO’s Global Centre on Digital Wages for Decent Work, organized a series of training sessions to support micro and small enterprises to shift from cash to responsible digital wage payments.

From 20 to 28 May 2024, we offered five one-day training courses to a total of 102 business owners or administrators, human resource personnel, accounting and administrative assistants from the regions of Cusco and La Libertad. In both regions, most participants were women. In Cusco, they mainly represented micro-enterprises (94 per cent) while in La Libertad it was a balanced proportion of micro and small enterprises. In Cusco, enterprises were mainly engaged in the tourism sector, while in La Libertad, they were active in the agriculture, retail, and services sectors. Most of the enterprises continued to pay cash wages, with a greater proportion in Cusco (61 per cent) compared to the La Libertad (48 cent).

The enterprises understood the benefits and identified challenges

The participants showed interest in digitizing wage payments but acknowledged that the topic was still new to them. There is a need to raise awareness of the enterprises and their workers about the benefits of digital wage payments. Enterprises often lack skills and knowledge about using technology, and in some cases fear or reject it, due to scams and cyber theft. Enterprises are unsure about the types of contracts and work modalities they should use for their employees, in particular those in casual and seasonal functions. It complicates the wage payment processes and the wage digitization. Participants urged regulatory agencies to disseminate more broadly information about workers’ right to choose the accounts where wages are deposited.

“[The digitization of wage payments] is a measure that is more convenient, more transparent and that saves more time than anything else. In some way or another, it also helps to generate a credit history. It would help enterprises to access loans to grow their business.”

– Luz Chahuillco, Administrator, Ají Seco Brass, Wanchaq – Cusco

Enterprises explored tools to facilitate the digitization of wage payments

During the course, participants explored various tools to guide wage digitization and learned the steps to follow to ensure a responsible transition. They recognized the importance of engaging financial service providers and communicating the benefits and limitations of various types of financial and payroll accounts, to build trust between financial service providers, enterprises and workers. Participants appreciated the importance of sensitizing and building the financial literacy of their workers to maximize the benefits of digital wages.

“Managing wage payments in a digital and responsible way is the best way for an enterprise to be much more profitable.”

– Hans Terrones, Administrator, Asociación Productores Orgánicos la Perla del Norte, Chepén – La Libertad

Enterprises are committed to adopt digital wages

Most enterprises that participated in the training expressed keen interest in shifting to digital wage payments. They also realized that, in an increasingly digital world, they need to strengthen their capacities in financial education, the use of new financial technologies and the negotiation with financial institutions. The Global Centre and its local partners have set up a mentoring and advisory support service to assist enterprises to put their learning into practice and digitize their wage payments.